NFT Bluechips Guide

Market Meditations | December 8, 2021

In traditional markets, a blue chip asset represents a well-established company with a long term track record of performance.

Such assets make up market indexes such as the S&P 500 and are consistently used as an industry benchmark due to their ability to remove the noise of new and poor performing assets.

Given the saturation of the NFT market, this method is particularly ideal.

- The Nansen Bluechip Index looks at a basket of 20 established NFT collections selected for their high liquidity and market cap.

- This list is updated on a quarterly basis and consists of well known projects including Crypto Punks, Bored Ape Yacht Club, VeeFriends and Meebits.

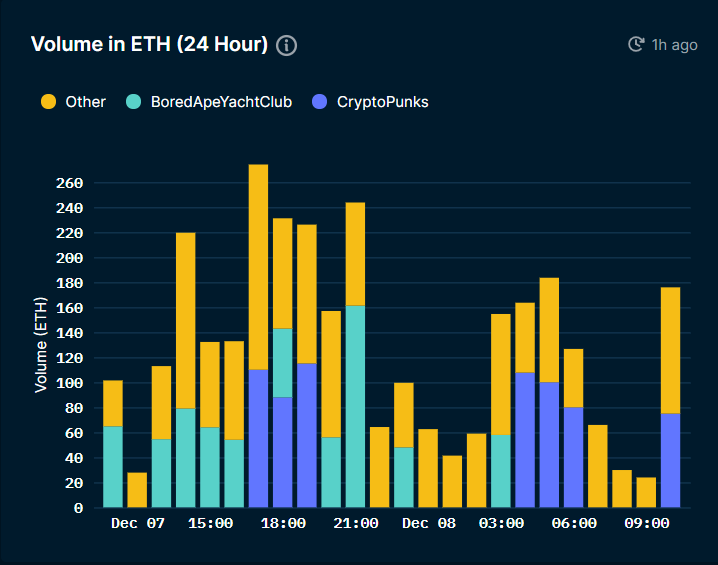

1️⃣ Blue chip activity over 24 hours

Nansen.ai: 08/12/2021 – Bluechip NFT volume over 24 hours

- This chart demonstrates how much volume is currently dominated by just two collections within the Bluechip Index – Bored Apes and Cryptopunks

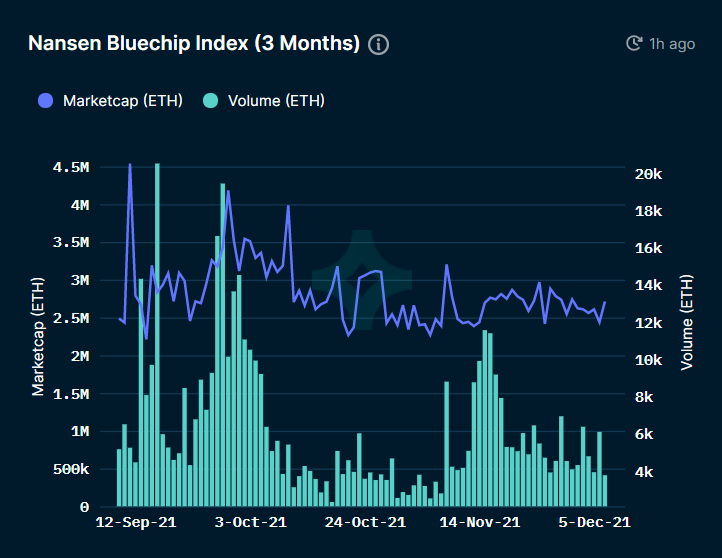

2️⃣ Bluechip Activity over 3 months

Nansen.ai: 08/12/2021 – Bluechip NFT Index. Market cap and volume over 3 months

- The graph shows that both the market cap (the combined value of all the NFTs in a collection) and volume transacted of Bluechip NFT projects are on a downtrend and have been for the last 3 months.

- Whilst there have been short term spikes in trading activity, this has only acted to stall the downwards trend.

? Conclusion

As the NFT market matures, we become more able to track key metrics that help us understand when to enter and how to profit from the sector.

Nansen provides actionable information which we can then use as a benchmark to understand long term performance, cutting away the noise.

Once we understand the long term trend, we are able to decide whether we want to actively participate in the market, or turn our attention elsewhere.

Bottom line? Get up to speed with Nansen insights to prepare for top trends in crypto in 2022, such as NFTs.