Beginner’s Guide to Owning Cryptocurrency

Market Meditations | August 2, 2022

Earn your first crypto. Today.

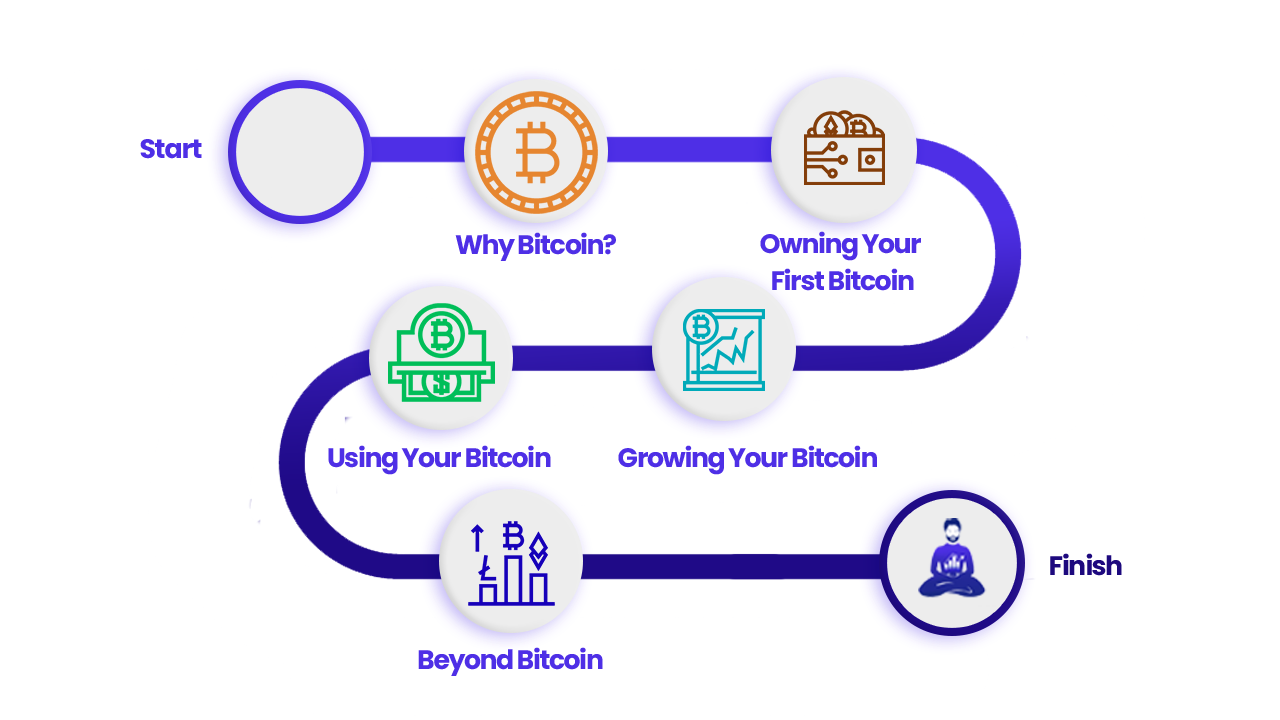

Stage 1: Why Bitcoin?

Simply put, Bitcoin is a new form of money that’s completely digital. Here’s why Bitcoin is revolutionary:

- Decentralised – Meaning no person, bank, institution or government controls it. Usually, to transfer money, you would need to go through a bank, or a company like PayPal, and they often take a cut of your money. Bitcoin allows you to transfer from one person to another directly with negligible fees.

- Counterfeit Proof – Bitcoin solves the problem of counterfeit money.

- Global – Bitcoin is a universal currency that can be used anywhere in the world. It removes the hassle of transferring between currencies and the fees involved.

- Limited Supply – Unlike traditional (fiat) currencies where the government can (and does) print money (making your money worth less), there will only ever be 21 million BTC – that will continually increase in value.

- Divisible – Regular currencies can only be divided to the nearest pence (2 decimal places). Bitcoin is infinitely divisible. So you can spend any exact quantity you want.

Q: Why wouldn’t I just stick with the bank?

A: The old financial institutions are broken, outdated, slower and more expensive. The profits are spent on skyscrapers, bonuses, and lawyers. Also they control your money, you don’t.

Q: Am I too late?

A: By far the most common question we receive. NO you are not too late, currently less than 2% of the world owns bitcoin.

Q: How big can this get?

A: Bitcoin is often described as a digital store of value, so it makes sense to look at gold’s market cap to find a long-term target. If bitcoin ever manages to reach gold’s market cap (approximately 8 trillion dollars), the value of a single Bitcoin would be worth $380,000. As the Winklevoss twins wrote last year, there is certainly a case to be made for a $500,000 Bitcoin in our lifetime. If something like this does happen, do you think it matters whether you bought bitcoin at $20,000 or $30,000?

✅ Congratulations you’ve completed stage 1! You already know more about bitcoin than 90% of the world.

Stage 2: Owning Your First Bitcoin

Now that you know how broken the old system is, and how good a solution bitcoin is, I’m sure you’re eager to own your first Bitcoin… But let’s make sure we understand how to store and use it first!

Crypto is stored in a “wallet”. A wallet is like a bank account, except you have complete control over it. Each Bitcoin wallet has a unique address, so you can send money to and from it. Here is an example of what a wallet address may look like:

EorI5ZobC7Fl1WTaOrQQviSWUNIxTmA8bq.

Think of this wallet address as your bank account number. If someone wants to send you bitcoin they would send it to this address.

Anybody who has a private key (or ‘digital signature’) can send Bitcoin from that wallet (so keep your private keys safe!) and each Bitcoin address has its own private key. Here is an example of what your private key may look like:

UPJP1uoDwpvptl9J2oBccDvHJeSUDQBf9kV6IA72R3gH1YekLIs.

How to Send and Receive Crypto:

To Send:

- Open your wallet or exchange and click “Send”

- Choose the wallet from which you want to send crypto

- Copy and paste the wallet address of the person to whom you are sending Bitcoin

- Enter the quantity of Bitcoin you want to send

- Click “Send”

To Receive:

- Open your wallet or exchange and click “Receive”

- Choose the wallet to which you would like to receive crypto

- Your wallet will automatically create a wallet address for you

- Copy this address and give it to the person who wants to send you Bitcoin

Read our comprehensive 9 step crypto security guide for more information on our favourite wallets and protecting your cryptocurrency.

Time to Buy Your First Bitcoin:

- Pick a Bitcoin Exchange.

- Create an account

- Add a payment method

- Buy Bitcoin. How much to buy depends on your personal situation, generally dollar cost averaging is the most beginner friendly way to do this.

✅ Congratulations you’ve completed stage 2! You are now part of the <2% who own Bitcoin, and you’ve taken your first step to opting out of the broken system.

Stage 3: Growing Your Bitcoin

You have acquired your first Bitcoin. How can you put your purchase to good use and grow your stash even more? Let’s rank some options to get you passive income streams.

- Earn Interest on your Bitcoin. Banks give you 0.5% APY… if you’re lucky. In the crypto world we have the option to stake/lend our cryptocurrency to get up to exponentially higher returns! There are currently many companies which offer rewards for holding crypto on specific platforms, like Nexo. Decentralized platforms like Aave are also an option, although these are more complicated to use.

- Mine (Not recommended). Mining used to be an easy way to earn Bitcoin. As with any lucrative business, it has gotten more competitive. Now, without competitive electricity costs and specialized mining equipment, you will struggle to make any money.

- Trade. Trading is a viable option if you’re willing to put in the work to master the skill. As with any job, it takes years to master the craft. We have a free Technical Analysis and Risk Management course to get you started. Platforms like FTX (FTX.US US users) allow traders an easy way to trade Bitcoin and altcoins.

✅ Congratulations you’ve completed stage 3! You now have a range of tools at your disposal to outperform the banks and grow you own wealth.

TIP!: Introduce yourself to the space before you dive straight in. We have a multitude of resources including our: podcast and YouTube.

Stage 4: Using Your Bitcoin

Spending Crypto

There are two primary ways to spend crypto:

- If the business you are purchasing a good or service from accepts crypto, then all you need is that business’s wallet address pay with Bitcoin.

- If the business doesn’t accept crypto, you can use a prepaid debit card, such as FTX‘s. This works in a similar way to a Monzo, or Revolut card. The difference is instead of converting from euros to dollars, you’re converting from Bitcoin to dollars.

Accepting Crypto as a Business

Accepting crypto as a business was once a complicated process.

But not longer! New companies are allowing you to start accepting cryptocurrencies like you accept regular currency every day. If you want the benefit of accepting crypto from over 300 million global users, but wish to avoid the hassle of storing and converting it into fiat, and you are looking for such a solution with built-in protection to curb fraud, there are a number of reliable solutions available to business owners.

Taxes

Disclaimer: Anything written in this section does not constitute financial advice and is for informational purposes only. Please consult with your own legal, tax, and accounting advisory team before making any decisions.

Tax laws will differ based on where you live and the regulation your country’s government has put into place. Here are the basics of what you need to know: taxable transactions include selling cryptocurrency for fiat, exchanging one cryptocurrency for another cryptocurrency, buying goods or services with cryptocurrency, and receiving any cryptocurrency (i.e. gifts, mining rewards, staking rewards, etc). Finally, here are things that differ depending on your individual situation:

- Amount of tax that you have to pay (i.e. tax rate)

- When you must pay that tax (i.e. annually, quarterly, etc)

- What forms you must submit to pay the tax

Disadvantages and Risks

- Volatility. Volatility in any new emerging industry is extremely high.

- Being Your Own Bank. Sounds fun, but comes with a lot of responsibilities. If you lose your wallet or private keys, they’re gone forever. Take control of your security.

- No Guarantees. Last but not least, there are no guarantees that the cryptocurrency you hold will still be valuable in 5 years. Don’t invest with money you can’t afford to lose.

- Scams. Here’s a general rule of thumb to avoid scammers: if it sounds too good to be true, it probably is.

✅ Congratulations you’ve completed stage 4! You can now integrate Bitcoin and cryptocurrencies into your business and life.

Final Stage: Beyond Bitcoin

Bitcoin gave us digital money.

Then came Ethereum, giving us the ability to build decentralized applications.

In 2020, we were introduced to decentralized finance (DeFi), an attempt to build an alternative and open financial system on the blockchain that allows users to borrow, lend, trade and insure. Decentralized applications are not controlled by a central party and cannot be shut down.

Welcome to the future.

Congratulations you’ve reached the end of this guide! Continue exploring this incredible space, innovation is around every corner.

Concluding Remarks

You can consider this guide to be your pocket oracle for financial liberation. You are as exposed to the current financial system as you choose to be. In this letter, we have given you the tools to start your market meditation. Of course, it is up to you to use these tools. Reread the article and leverage the range of articles we have referenced in order to continue to grow and develop the foundation you have created today.

Good luck and let us know how you get along.