DAO Guide

Market Meditations | June 22, 2022

? When the Market Goes DAOn

Traditional governance structures have a number of issues in today’s world including a lack of transparency and a hierarchical model that gives power to only a few. In this 2 part series, we will explore the current DAO landscape, asking ourselves, is there a better way?

A Decentralized Autonomous Organization (DAO) is a member-owned community with no centralized leadership where code is used to automatically enforce decisions.

Governance is controlled via ownership of its token which allows members to create and vote on proposals. Understanding the current DAO landscape can help you spot opportunities to get further involved in crypto and vet existing projects.

Different Kinds of DAOs

- Social DAOs: These exist to create communities of like minded individuals. They can be used to network or further a common goal.

- Protocol DAOs: Used to make decisions in the running of a decentralized protocol. If an active user of that protocol, you can vote on issues that may affect your use of the protocol or simply consider proposals to vet its community before making an investment.

- Investment DAOs: Participants pool together capital and make shared investment decisions. Whilst these can be difficult to become a member of, the profit opportunity is clear.

Most Valuable DAOs

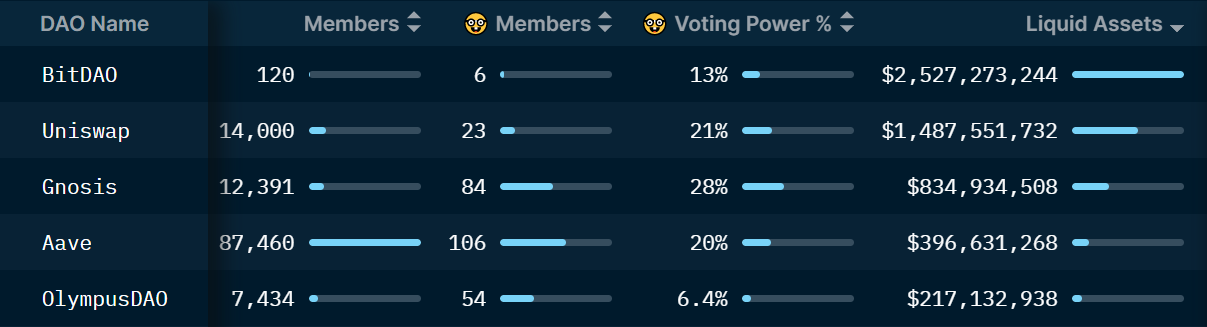

So how can we find the top DAOs to get involved in? Using Nasen we can see the DAOs with the highest number of liquid assets:

Nansen.ai: 22/06/2022 – DAO Billboard – Top 5 By Liquid Assets

- BitDAO: This is the largest DAO by liquid assets with over $2.5bn. Their goal is to build a decentralized tokenized economy that is available to everybody.

- AAVE: This is a protocol DAO that makes decisions on the running of one of the largest protocols in the DeFi space, AAVE.

✅ Tip: We can also use Nansen to find those with the most voting power in a DAO, showing who controls the organization and whether we want to get involved.

DAOs represent an exciting shift in governance structure that has the potential to open opportunities for anyone in crypto. Using Nansen we can identify the top DAOs via liquid assets or smart money members.

In part 2, we will demonstrate how to dive into DAO treasuries and use their on-chain movements to inform decision-making.