🧘♂️Hot Yield Farms For Beginners

Market Meditations | April 27, 2022

Dear Meditators

Another perfect storm of risk-off factors today. Interest rate hikes by the fed, geopolitical tensions off the back of the Ukraine-Russia conflict and also, disappointing Q1 2022 Earnings Reports by some of the biggest corporations, such as Google.

When it comes to big corporations, their earnings can reflect the health of the macro-economic climate. When big corporations suffer, their employees receive lower wages and as a consequence, they will have lower purchasing power and there is less money circulating around the economy. That’s the theory and it’s why the market responds badly to lower earnings.

Today’s Meditations:

- Part 1 of our Nansen x Yield Farming Tutorial: Finding the Hottest Ecosystems

- Optimism Airdrop Details Revealed

- Big Crypto News From Fidelity: Let the Flood Gates Open

With Nansen’s On-Chain data, you get an edge over everyone else by tracking the behaviour and on-chain activity of prominent wallet addresses.

- Exciting New Opportunities. Follow Smart Money, identify new projects, and trace transactions down to the most granular level.

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

⏰ Top Headlines

- 21Shares launches hybrid Bitcoin and gold ETP to enable inflation hedge

- As it weighs FTX proposal, CFTC announces a roundtable on disintermediation

- Ex-BitMEX CEO explains how Bitcoin will have hit $1 million by 2030

- Multiple Ivy League universities, KKR back Dragonfly’s new $650 million fund

? You Reap What You Sow

There has never been more choice when it comes to finding returns in DeFi. However, with so many new chains and protocols, it can be impossible to keep up with the highest returns.

For part 1 of our yield farming series (click here for a course breakdown) we will show how, using Nansen, we can track money flows across DeFi to see where both smart and retail money is flowing in real-time.

Identifying Hot Ecosystems

In order to use a blockchain, you must first transfer assets to that blockchain in a process known as bridging. Nansen allows us to track the smart contracts that facilitate this bridging showing how many top crypto investors are transferring their funds to a specific blockchain:

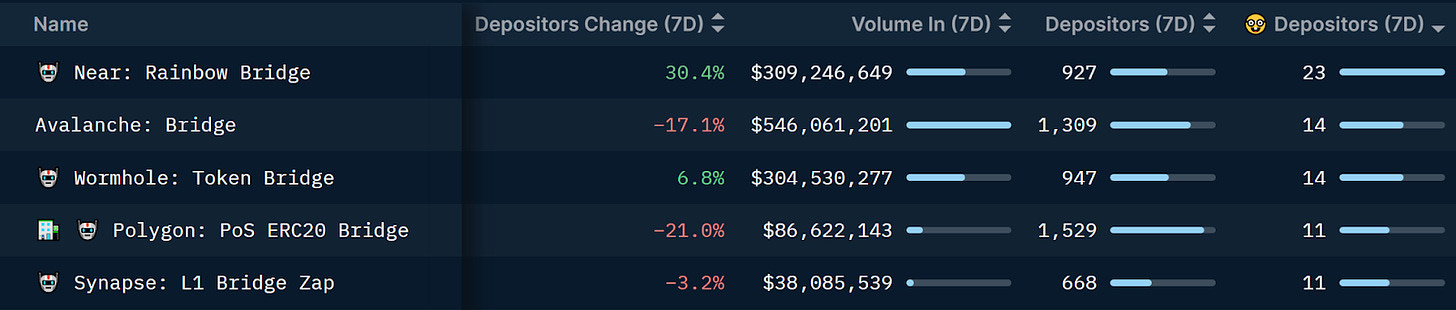

Nansen: 20/04/2022 – Bridge Builder sorted by number of Smart Money Depositors

- The Near blockchain has received the most number of smart money depositors indicating that there may be a number of opportunities on that chain.

- Avalanche is the second favourite chain amongst smart money. Whilst there are a large number of smart money depositors, total depositors have decreased over the last week, indicating there may be opportunities that less informed participants are not aware of.

Tracking the Smart Money

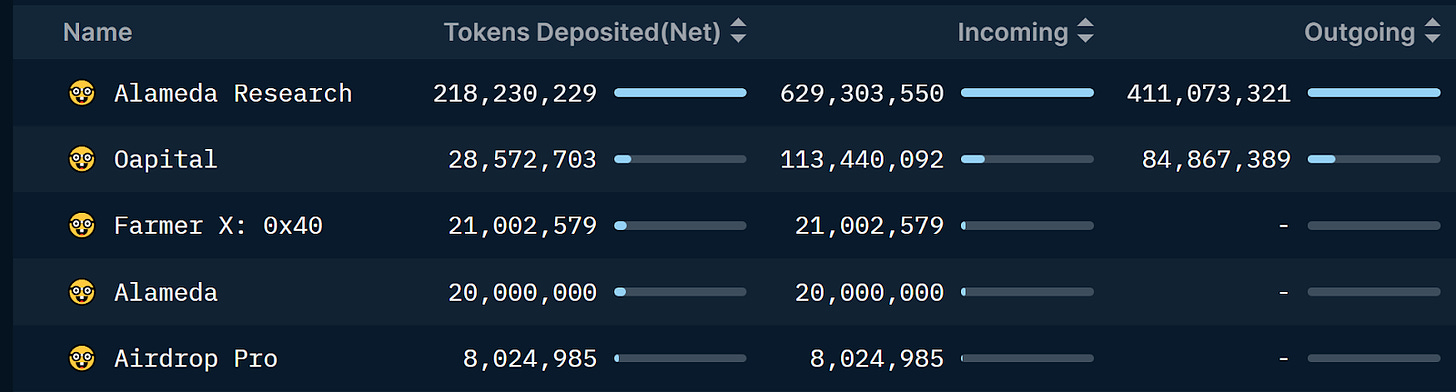

Now we have identified hot ecosystems, we can dive deeper into the smart money depositing assets into these ecosystems. Using Nansen we can see the top depositors of USDC (one of the most common assets used in DeFi) into the Avalanche Ecosystem:

Nansen: 27/04/2022 – Top Depositors of USDC into the Avalanche Bridge, filtered by Smart Money

- Tokens Deposited (Net) is an indication of the number of USDC tokens currently deposited into the ecosystem by individual wallets and reveals the investors that are taking advantage of opportunities on the blockchain.

- Most notable on this list are Alameda Research which have over $218m currently on the chain.

✅ Tip: With Nansen we are also able to dive deeper into the individual wallets, seeing exactly how notable investors such as Alameda are producing profits.

Conclusion

Yield farming has been a major source of profits for many top crypto investors in the last few years however is becoming increasingly difficult to keep track of. Using Nansen we are able to find the hottest ecosystems that are currently offering the best opportunities.

As with any indicator, one piece of data cannot be used in isolation and should be used in the context of a wider system. To understand all the risks involved check out the intro to our yield farming course and to build your own system, keep following the 5-part series. Next week, we demonstrate how you can find the hottest protocols identifying exactly where you are able to generate the highest returns.

✈️ Airdrop Battles

Last summer Layer 2 solutions made a big splash in crypto headlines and then settled into the background for development work. Until now. While others thrashed around in the panic of an impending bear season, these products started growing their userbase and fine-tuning their governance:

- Ethereum scaling solutions like Optimism and Arbitrum have been offering dApp services on their chains for many months. Both are optimistic rollups that have a withdrawal period of several days to allow for any fraud claims.

- When they launched, neither had their own cryptocurrency token, but that’s all about to change. Optimism announced a token yesterday ($OP) as part of a new governance structure called the Optimism Collective.

- The counterpart to the fungible token will be a series of non-transferable NFTs conferred to ‘citizens’, who will govern funding and protocol development.

- There will be several airdrops starting in Q2, and 250k addresses are currently eligible. Rewards are stackable depending on how many criteria users have met and there is a bonus for hitting four or more.

- Rumours are already flying that Arbitrum might fast-track their own airdrop, with some suggesting they already took a snapshot to prevent a surge of late users who missed out on Optimism.

- Arbitrum has been hit by some availability problems and rugs recently, that led one Twitter user to joke about what such an airdrop would look like.

To learn more about rollups check out our introduction here, and for more details on the future governance of Optimism you can visit their community documentation.

⛩️ The Floodgates Open

Fidelity is the largest provider of 401K plans in the United States, managing more than 1/3 of the market. As one of the first tradfi institutions to enter the digital asset space, they can now claim that title for offering bitcoin access in 401K accounts.

- Fidelity told the Wallstreet Journal and other publications that they would begin offering bitcoin in 401ks sometime this summer, thanks to growing interest.

- Plan sponsors must approve of any digital asset investment options for their enrollees on a company-by-company basis, with MicroStrategy already first in line.

- Fidelity currently proposes to allow plan members to allocate up to 20% of their portfolio to bitcoin but that number could change, and they intend to offer other digital assets as well.

- The Department of Labor is not in favor of this, recently issuing a compliance assistance document full of staunch warnings about crypto investments in 401k funds. Although they don’t ban crypto from 401Ks outright, they do suggest that cryptocurrencies do not yet meet that bar, adding that they would investigate plans that choose to offer crypto.

- According to Fidelity, the Department of Labor is substituting its opinion for what rightly belongs to plan sponsors. Fidelity also believes that its new digital asset account will address some of the Department’s concerns.

If Fidelity currently manages $4.2 trillion in assets, a 20% allocation to the digital asset space would be almost $1 trillion but that is not the only flood gate opening. The competition will drive other providers to offer their own clients access to crypto in their 401K as well. It may begin as a trickle but as pressure builds, the flood gates will open.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.