How to Use Nansen to Find DeFi Projects

Market Meditations | October 6, 2021

DeFi (or Decentralized Finance) refers to the system of financial products that is now available on the blockchain. Using Dapps (or decentralized applications), anyone is able to carry out financial transactions, such as lending, without a centralised entity (like a bank) – earning crypto for doing so. This is all enabled by smart contracts.

Consider a vending machine, upon entering your desired drink and the right amount of money, the vending machine will automatically distribute your beverage. A smart contract acts in the same way: they are computer programs that execute their function when triggered by predefined conditions.

We can use Nansen to dive into these smart contracts and find opportunities that we would have otherwise missed:

1️⃣ Hottest Contracts – Sorted by Smart Money Deposits Over the Last 7 Days

Using this metric we can see the contracts that have been interacted with by the most number of smart money wallet addresses (for a reminder of exactly what smart money is, check out Nansen’s wallet label guide).

- The top two contracts relate to Abracadbra.Money. This is an innovative protocol that allows you to use DeFi assets from well known protocols such as Yearn as collateral. A total of 17 smart money addresses interacted with these contracts, showcasing that rewards could be high as part of wider strategy.

- Convex Finance is another protocol that allows you to interact with a well known Dapp (Curve Finance) in order to boost yield. This time we can see 8 smart money wallets have interacted with this smart contract.

2️⃣ Hottest New Contracts

We can also filter the above table so that it only shows contracts created within a certain time frame. This allows us to find new smart contracts that have quickly gained traction with the wider market or within the smart money sector.

Doing so would reveal the 2 of the top 5 contracts belong to Paladin Finance – a new protocol that allows you to use governance tokens as collateral. However we can also see that there is only one smart money depositor – highlighting that this could be a very risky opportunity.

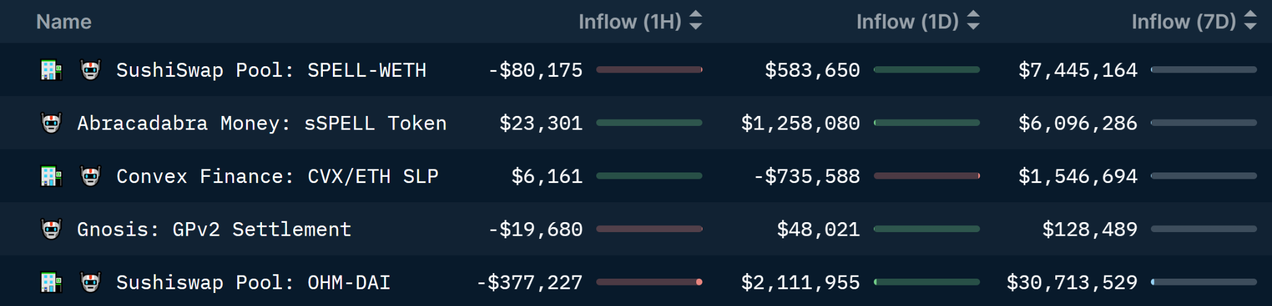

3️⃣ Balances Changes for USDC over the Last 7 Days

This metric shows the money flows of USDC around the Ethereum Network, sorted by biggest positive inflows.

- We can see that the top 4 represent well known, lower risk protocols such as Yearn, dYdX and Curve.

- This is no surprise with the growing number of projects that allow users to earn more yields whilst their funds are locked in the protocol

Conclusion

The opportunity to earn sizable yields in DeFi is everywhere. The problem is knowing where to find it. Using Nansen’s Hot Contracts and Balance Change features, we can discover ways to best optimize DeFi returns and over the next 3 weeks will dive deeper into specific metrics that help you start profiting from DeFi.