Introduction to Frax Protocol

Market Meditations | March 15, 2022

The Frax protocol is a two token system encompassing a stablecoin, Frax (FRAX), and a governance token, Frax Shares (FXS). It is the first fractional stablecoin which means its peg is partially backed by collateral and partially stabilized algorithmically. The developers are combining the best of both designs, which they believe will improve the long-term results better than stablecoins that opt for one extreme or the other.

How Is The Peg Maintained?

Frax uses a stability mechanism that maintains its peg via arbitrage. This means that financial incentives are provided for market participants to maintain the stability of the peg similar to Terra’s UST.

- FRAX can always be minted and redeemed directly from the system for $1 of value.

- Arbitrageurs have an incentive to acquire FRAX for less than $1 and redeem for more than $1, profiting off of the difference.

- This mechanism controls the demand and supply of FRAX on the open market to keep a stable peg of $1.

Why Is Smart Money Interested?

In crypto, we can use on-chain analytics to track ‘smart money’ to gain an edge in the market. Convex Finance, Olympus DAO, [Redacted] Cartel and Congruent Finance are key players accumulating Frax Finance (FXS).

Smart money is likely accumulating to benefit from the utility of the FXS token. By owning many tokens, they can offer the highest possible yields to their users, lock yields to drive liquidity, or generate cash flow from accruing fees.

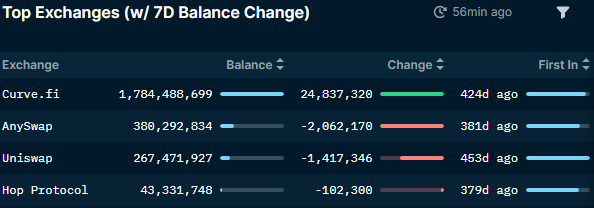

Nansen.ai: 14/03/2022 – FRAX Accumulation – Top Exchange 7 day balance change

According to data from Nansen, Curve.fi has added almost 25 million FRAX tokens in the last 7 days. The majority of inflow is likely a result of the Convex staking rewards program which recently went live.

Currently, users can earn between 24.54% to 25.4% vAPR if they choose to provide liquidity for the FXS pool on Convex Finance. Crypto investors that explore these avenues are aware of the risks. The risks associated with Yield Farming include, but are not limited to: Smart Contract Risk, Oracle Failure, Governance Attacks, Yield Fluctuation, Impermanent Loss (learn more about it here), Systemic Risks and De-pegging of Assets.

There are no guarantees in DeFi. Always do your own research and never invest more capital than you can afford to lose.