🧘♂️ALERT: 2 Hot Cryptos

Market Meditations | February 9, 2022

Dear Meditators

There are huge profits to be made by identifying hot tokens. But, where do you start? One option is to use Nansen to uncover opportunities that the most successful crypto investors are taking advantage of right now.

In this series we are going to show you how anyone can do exactly that, also demonstrating how we can assess a token, once we have uncovered the opportunity. Today, in part 1, we are going to run you through the first step: spotting those opportunities.

Today’s Meditations:

- Top Headlines

- Billion Dollar Heist: 2 arrests made in connection with 2016 Bitfinex hack of $3.6 billion worth of Bitcoin

- Identifying Hot Tokens – Part 1

- We identify 2 hot cryptos according to smart money token holdings

- Republicans and Democrats Talk Crypto

⏰ Top Headlines

- US government seizes $3.6 billion in bitcoin tied to 2016 hack of crypto exchange Bitfinex (More details in following section)

- Russia set to recognize crypto as a form of currency

- Upcoming Apple iPhone feature to give merchants a way to accept crypto payments

- Shiba Inu Enters the Metaverse With ‘Shiba Lands’, LEASH Rockets 40%

? Billion Dollar Heist

What do you do when you’ve got nearly $4 billion worth of stolen cryptocurrency? You’re rich, but you can’t tell anyone; you’re a billionaire but you can’t spend it easily. We’re talking of course about the Bitfinex hack in 2016, where nearly 120,000 BTC were stolen, and where U.S. authorities have just announced a breakthrough:

- Although small amounts have been moved around since then, it wasn’t until last week when whale alerts suddenly picked up a 10,000 BTC move to an unknown wallet.

- This was followed quickly by another ~85,000 BTC, with the total value currently sitting at ~$4.1 billion.

- To the delight of Bitfinex CTO Paulo Ardoino, the U.S. Department of Justice announced yesterday that they had recovered the funds from the hack and revealed the names of the suspects trying to launder the money.

- Hiding in plain sight was a married couple called Ilya “Dutch” Lichtenstein and Heather Morgan – the former a self-proclaimed angel investor and web3 developer, the latter an entrepreneur, artist, rapper and fashion designer! Since their unmasking there has been a mass unfollowing of their Twitter accounts.

- Not only did they hide their affluence, but they were also active in the cryptocurrency and cybercrime space. Ironically enough, Heather was a Forbes’ writer as well as the CEO of Endpass, “which uses AI to automate identify verification while proactively detecting fraud”.

- They were arrested yesterday morning and appeared in court in the afternoon, where they (somewhat surprisingly) were granted bail.

So, given the staggering rise in value since 2016, perhaps being a victim of the hack will turn out to be the most foolproof HODL strategy around!

? Identifying Hot Tokens – Part 1

Step 1: Look at Changes in Smart Money Token Holdings

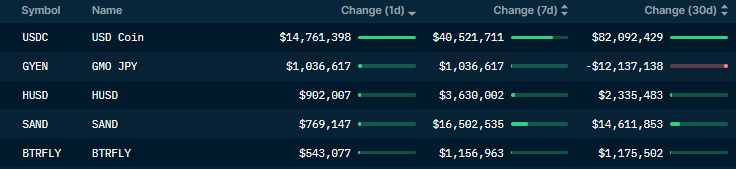

This table shows the flow of tokens into Smart Money wallet addresses and is a good way to spot what the most successful investors are currently doing with their assets.

Nansen.ai: 09/02/2022 – Smart Money Token Holdings (sorted by Change Over 1 Day)

In our example:

- Most of the top tokens are stablecoins. This often shows that Smart Money is becoming risk off or that there are good yield farming opportunities on those specific stablecoins.

- SAND is the token for metaverse gaming project The Sandbox.

- BTRFLY is the token behind Redacted Cartel – a project looking to combine the popular DeFi protocols, Convex and Olympus DAO.

We have now found two potential opportunities that we can dive deeper into.

Step 2: Navigate the Data to Find Even More Opportunities

Looking at positive changes to Smart Money token holdings is only one way we can discover new opportunities. To gain even more actionable insights we can:

- Sort by outflows to see if Smart Money is exiting certain coins.

- Sort by time frame to find opportunities that fit your strategies.

- Filter by smart money segments. For example the Smart Liquidity Provider category will focus on DeFi coins however Smart NFT Money categories will focus on NFT coins.

- Use the “Token Flows” feature to filter by token age. This allows us to focus on newer coins where there may be higher rewards at the cost of greater risk.

Reminder: At this stage we have not done any due diligence on these tokens. We are therefore not ready to make an investment with this information alone.

Conclusion

This week we have shown how you can use Nansen to identify hot tokens by considering the activity of the most successful crypto investors. We have then also shown how to tailor this information to focus on any sector where you may have your own alpha, whether this is NFT’s or DeFi.

?? A Bipartisan Issue

A crypto-related proposal brought by the US Department of Treasury’s Nellie Liang found some bipartisan opposition in the House Financial Services Committee yesterday. Liang, an undersecretary for the Treasury, urged the Committee to limit the type of institution that could issue stablecoins to only IDIs, which found resistance from both sides of the aisle. An IDI is an institution with FDIC insurance, or a bank.

- Gregory Meeks (D-NY) “It occurs to me that limiting stablecoin issuance to IDIs, which have a high barrier to entry, could limit competition. Such recommendations could have a racial equity impact.”

- Another Democrat from New York, Ritchie Torres, thinks the best regulation would be “common sense rules.” One reason for Torres’ criticism of the IDI proposal is because Circle, the issuer of USDC, has not been able to obtain a bank charter although they have applied for one.

In the recent past, it was Republican members who have been more crypto-friendly and opposed to stifling innovation in the digital asset field, but today’s hearing saw more Democrats jumping on board.

As reported by The Block, Democrats are finally becoming receptive to crypto’s potential impact on the unbanked, minority communities & cross-border payments. This could be thanks to the increasing presence in DC by the crypto industry.

With Nansen’s On-Chain data, you can secure an edge in the crypto and NFT markets:

- ? Exciting New Opportunities. See where funds are moving their money.

- ? Perform Due Diligence. Get more information on projects or tokens.

- ? Defend Your Positions. Create smart alerts to track over 100 million ETH wallets.

- ? Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in

To grow your crypto portfolio today check out the Nansen website. Currently, they are running a 7 day trial for just $9. Link here ?

Next week, in part 2 of our Hot Token series, we will demonstrate how we can dive deeper into any token, helping you decide whether to buy, sell or hold your assets.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.