🧘♂️ALERT: Hot New DeFi

Market Meditations | March 24, 2022

Dear Meditators

Crypto is full of excitement with rumours of the Luna Foundation Guard following through on its plans to buy $3 billion worth of bitcoin to introduce a new BTC-backed reserve UST stablecoin.

Today’s Meditations:

- Everyone’s Talking About ThorChain

- Understanding How CashioApp Was Exploited by a Robinhood Hacker

- Thailand Bans Crypto as a Means of Payment

⏰ Top Headlines

- Waves Breaks Into Top 50 Crypto Rankings With 240% Monthly Gain

- Cosmos Protocol Archway Raises $21M to Provide Developer Rewards

- Stargate bridge attracts $2 billion of liquidity within a week of launch

- Digital currencies could get a boost from the international crisis: BlackRock CEO

⚡ Synthetic Swaps

The price of RUNE, the native DEX token of THORChain, has appreciated over 40% following its launch of synthetic trading assets on March 9th.

As expected, THORChain’s total TVL is very close to RUNE’s price action. On the heels of the introduction of Synths, RUNE took a major step to the upside as money poured into the protocol.

THORChain’s cross-chain Decentralized Exchange (DEX), THORSwap, added synthetic versions of major tokens like Bitcoin, Ethereum and Litecoin among others earlier this month.

TIP! Synthetic Assets mirror real-world assets like gold and stocks, or in THORChain’s case – native cryptocurrencies. Their value is pegged to the underlying asset and takes a synthetic form represented by a token.

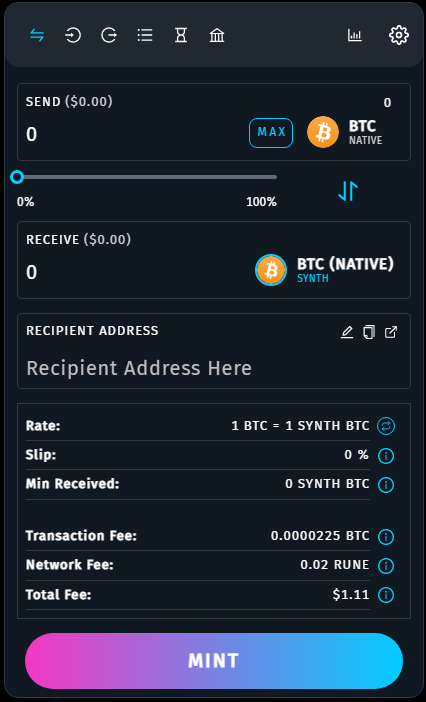

THORSwap also features several other DeFi staples, like liquidity pools and farming, but today we’re looking at minting synths to take advantage of much lower fees and transaction times while moving in and out of positions.

Users on THORSwap interact with the protocol through the following steps.

- Visit THORSwap to connect your wallet in the top right corner of the screen.

- After getting connected, pick whatever asset you’d like to mint and click appropriately. By completing this process, you will turn your native asset, BTC in this case, into a synthetic version tradeable on the THORSwap DEX.

TIP! The transaction fee will be denominated and paid by the native asset. Transaction fees are usually much higher for minting a Synth than swapping.

- After minting the synthetic version of your preferred underlying asset, you’re free to enjoy low transaction fees and fast transaction speeds. Arbitrageurs and traders value these upsides to quickly seize narrow windows of opportunity.

There are no guarantees in DeFi. Always do your own research and never invest more capital than you can afford to lose.

As previously mentioned, THORSwap offers other potentially lucrative DeFi opportunities like liquidity pool provision. When staking multiple assets in an LP, there is risk of impermanent loss. THORChain has implemented an impermanent loss insurance formula for liquidity providers staking more than 100 days.

Synthetic assets aren’t new to crypto. Mirror Protocol is an established player in the digital representation of real-world assets like gold and stocks. THORChain’s Synthetics offer an edge when trading between flagship tokens on slower, more expensive networks. An upcoming feature will also allow single-sided LP with no impermanent loss.

Though THORChain has been audited by Paladin and has a respectable TVL, we cannot stress the importance of due diligence enough. In September of last year, the protocol suffered a hack totalling around $8 million.

Want to learn more about THORSwap Finance’s Synthetic assets? Have a look at the project’s tutorial here.

? $CASH Grab

CashioApp is a DeFi project built on Solana that aims to create a USD pegged stablecoin called CASH that is backed by interest-bearing tokens. It manipulates the supply of the tokens using mint and burns mechanics in an attempt to maintain its peg.

- On March 23rd 2022 the CashioApp protocol was exploited. The hacker managed to mint 2 billion CASH tokens using 2 billion of his own unknown tokens.

- How the hacker was able to exploit the code has been broken down in a thread by @samczsun here.

- Using the 2 billion CASH tokens that were minted, the hacker used Cashio’s platform to burn CASH tokens for all the underlying Saber USDT-USDC LP tokens in Cashio’s deposits.

- The hacker was able to drain $52.8 million worth of USDC, USDT and UST from Cashio and Saber.

- The hacker embedded a hidden message within a transaction which can be viewed via their Etherscan which suggests this was a Robinhood attack.

- The message reads “accounts with less than 100k will be returned, all other money will be donated to charity”.

According to SolanaFM, it would seem that the hacker has at least begun returning the stolen USDC to wallets with less than $100k worth of value but the charity donation is yet to be seen.

?? Thailand Bans Crypto as a Means of Payment

Let’s learn more about the Thailand Security and Exchange Commission’s decision to ban crypto as a means of payment.

- As of April 1, there will be a ban on the use of crypto as a means of payment in Thailand.

- The Thai regulator cited money laundering and the inability of the central bank to intervene and help as the reason behind the ban.

- The Thai SEC made it clear that this is not a ban on crypto trading and digital assets.

- They additionally said that digital assets do not provide efficiency, citing price volatility and high transaction fees.

While this appears to be bad news and that the Thai population will cease to use crypto, we should note that trading may actually increase! We should remember that earlier this month, Thailand announced that crypto trades on government-approved exchanges will be exempt from the 7% value-added tax (VAT) until 2023.

Nexo offers a simple, secure way to build your crypto portfolio.

Get a $100 welcome bonus, paid out in Bitcoin.

We’re Watching

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.