🧘♂️ALERT: Price Up 60%

Market Meditations | April 21, 2022

Dear Meditators

If the SOL and AVAX runs late last year taught us anything, it’s this: Don’t be blind to emerging L1 Ethereum competitors.

We prefer 20/20 vision, which is why today we are going to talk about Near Protocol.

With a market cap of over $11 billion, and having recently seen a tear upward to the tune of a 60% price increase earlier this week, NEAR Protocol is being compared to Solana and Avalanche by some crypto connoisseurs.

Today’s Meditations:

- Introduction to Near Protocol: About, Key Events & Key Opportunities

- Spot BTC ETF Set to Launch

- Lights Out for Algorand?

⏰ Top Headlines

- Cricket NFT startup Rario raises $120M in Series A funding

- German banking giant Commerzbank applies for crypto license

- Aurora-based DeFi protocol Bastion raises $9 million in funding led by Three Arrows Capital

- Aptos Labs strikes first cloud partnership deal with Google

? NEARSighted

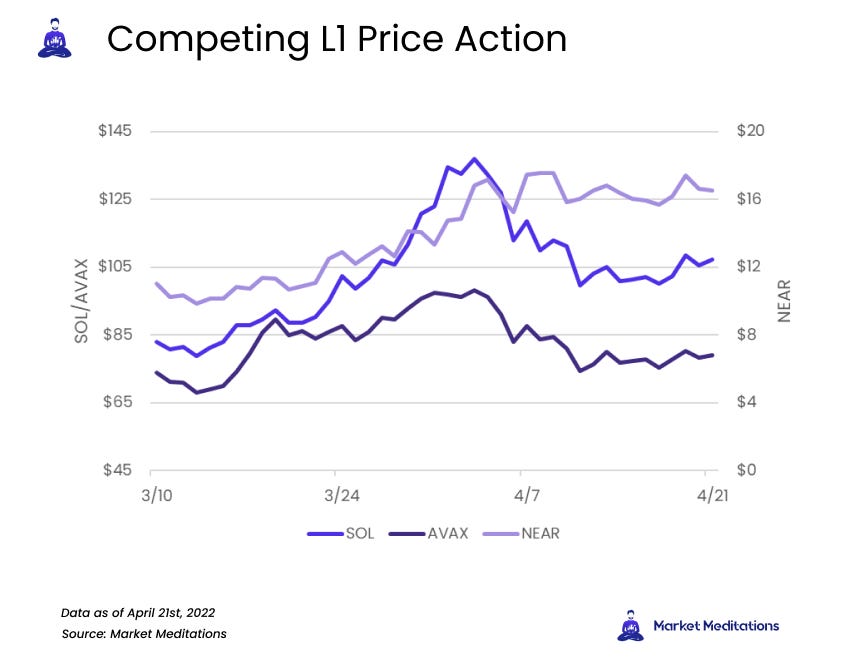

NEAR Protocol has been outperforming other so-called “Ethereum Killers” over the past two weeks. Just take a look at the chart below.

➡️ Key Events

Founded in 2018 by former Microsoft software developer Alexander Skidanov together with former engineering manager at Google Research, Ilya Polosukhin, NEAR is a sharded, proof of stake, layer-one blockchain designed for usability.

- Earlier this month, NEAR Protocol raised $350 million in a funding round led by Tiger Global. More VC investments in projects building on NEAR are expected to be announced in the coming weeks.

- NEAR protocol has been gaining momentum in the DeFi sector as well, jumping over $400 million since the middle of February this year. With only 5 protocols listed for the NEAR network on DeFiLlama, it looks like NEAR might not be far from exploding.

- Near protocol is attracting builders by offsetting carbon footprints. Last year, NEAR was awarded the Climate Neutral Product Label, earning it a spot on the short list of networks fighting for the prestigious designation of eco-friendly technologies.

TIP! Sharding is the method of splitting a blockchain into smaller partitions to spread the processing workload more evenly to achieve a higher throughput.

➡️ Key Opportunities

Near Protocol has its fingers in many pies, but these are the sweetest:

DeFi Anyone?

- Ref Finance is the leading DeFi Protocol by TVL with over $200 million. It’s a decentralised exchange featuring staking, LP farms and swaps.

- Meta Pool is a liquid staking solution running on the NEAR blockchain.

- Burrow is primarily a lending protocol, bringing one of the most popular mechanisms in DeFi to the NEAR ecosystem.

NFTs Please

- Mintbase launched on NEAR protocol last year and currently features almost 150,000 NFTs. The largest NFT platform on the network chose to launch on NEAR after NFT minting on Ethereum became too expensive.

- Paras is a competing marketplace focusing on digital collectibles. Beginning with digital art cards inspired by real-world trading cards, Paras has expanded to feature familiar NFT themes found on most platforms.

Those l?king to make the leap and use NEAR protocol have to migrate assets to the network. Luckily, doing so doesn’t require Heimdall’s permission – just a few easy steps.

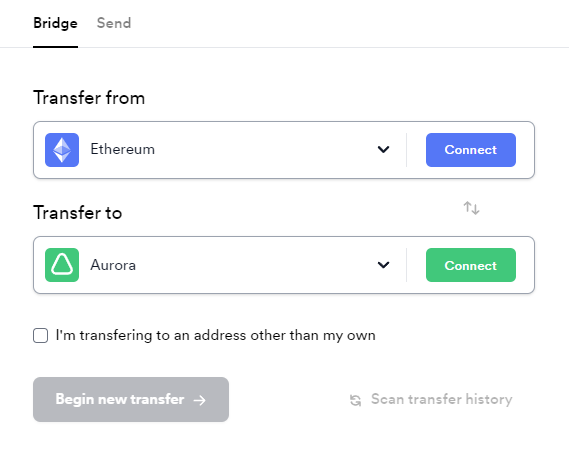

Rainbow Bridge is the oldest and most popular solution to switch tokens between Ethereum, Aurora, and Near.

- Crossing Rainbow Bridge presents users with an easy solution for importing assets. Selecting which networks to use and clicking “Connect” gets us started.

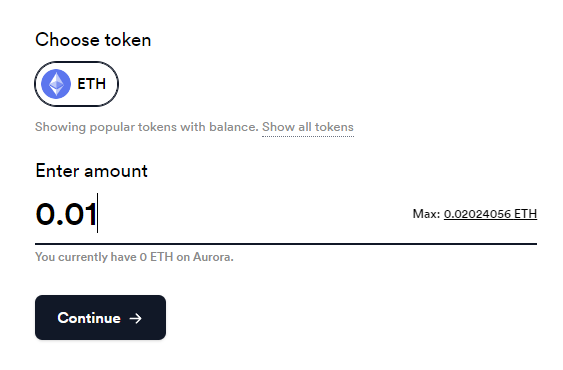

- Once connected, selecting an amount and clicking “Continue” will prompt the remaining transaction approval steps.

After funds have arrived at the chosen destination, users are ready to dive as deep as they dare into nearly anything.

Near has strong fundamentals and a proportionately young ecosystem. Taking a closer look into this growing L1 now may prevent hindsight in 20/20 from haunting you in the future.

Wanting to keep a watchful eye on NEAR? Check out their YouTube here.

? Spot BTC ETF Set to Launch

The U.S. and other regions have been trying to get a spot bitcoin ETF for quite some time now. Australia has done it! Next week, they are set to launch their first spot bitcoin ETF. Let’s take a closer look at the details, as well as current sentiment in the U.S. to get this same ETF approved.

- Switzerland-based ‘21Shares’ teamed up with ETF Securities to launch the funds. They are launching a bitcoin ETF and an ethereum ETF (both spot ETFs).

- As a reminder, a spot ETF trades based on the current price of bitcoin and ethereum [in this case]. This is in contrast with futures ETFs.

- Both of these ETFs will be tracked in Australian dollars and will be fully backed by the assets (BTC and ETH) held in cold storage on Coinbase.

- Both ETFs are expected to list on the Cboe Australian exchange on April 27.

- While many in the U.S. were pessimistic that such an ETF would get approved this year, the sentiment has changed to hope.

- The SEC has rejected numerous spot ETFs because of concerns about the lack of investor protection and market surveillance.

- It appears that a couple of spot ETFs will be submitted through a different [security] act — one which the SEC chairman appears to be more comfortable with (act 40). For more information, click here.

These ETFs are useful in getting an older generation on board. While an older generation may not log on to an exchange to purchase crypto, they are likely to experiment through these ETFs.

? Lights Out for Algorand?!

Ranked #30 overall by CoinGecko with a market cap of over $5 billion, Algorand has returned to headlines after capturing investor attention last September with a parabolic price increase. But the green behind Algo’s popularity isn’t related to price action this time around.

- The proof-of-stake blockchain protocol will begin offsetting its network’s carbon emissions by taking a portion of each transaction fee and using it to purchase carbon credits at ClimateTrade, a blockchain carbon offset marketplace.

- Monday, the Algorand Foundation said it will darken its Times Square exhibit for an hour to exhibit its dedication to sustainability.

- Algorand Foundation CEO Staci Warden described the initiative as means to allow the network to scale while being carbon neutral as part of a long-term goal to remain eco-friendly.

TIP! Carbon credits are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gas and were originally devised as a mechanism to reduce emissions.

Regardless of personal views regarding climate change, the topic remains at the forefront of the industry at the global level. The climate impact of Bitcoin mining has been a hot issue in the evolving state of regulation, and companies are eager to earmark eco-friendly measures in an effort to avoid future red tape.

For a broader overview of blockchain’s approach to climate impact, start here.

Nexo offers a simple, secure way to build your crypto portfolio.

Sign up Now & Get $100 in BTC!

- Justin Sun to launch algorithmic stablecoin USDD on Tron, will use $10 billion of crypto as collateral (via @OsatoNomayo) – The Block

- NEW: @zhusu’s Three Arrows Capital led a $9 million Series A for @NEARProtocol DeFi project @BastionProtocol. – Coindesk

We’re Watching

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.