🧘♂️How to find HOT Cryptos

Market Meditations | February 23, 2022

Dear Meditators

Last night, President Biden imposed a wave of sanctions on Russia for the Ukraine ‘invasion’. This firm stance seems to have eased nervousness in the market. At least for the time being… with risk assets such as stocks and cryptos experiencing a relief rally.

We are still a while away from being bullish again, however. Which is why we are focusing today’s newsletter on better, quicker and smarter ways to identify hot tokens ?

Today’s Meditations:

- Hot Token Guide, using Maker DAO as our example

- Latest on LUNA and the UST explosion

- Introducing the Pacific Stock Transfer

With Nansen’s On-Chain data, you can secure an edge in the crypto and NFT markets:

- ? Exciting New Opportunities. See where funds are moving their money.

- ? Perform Due Diligence. Get more information on projects or tokens.

- ? Defend Your Positions. Create smart alerts to track over 100 million ETH wallets.

- ? Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in

To grow your crypto portfolio today check out the Nansen website. Currently, they are running a 7 day trial for just $9. Link here ?

⏰ Top Headlines

- Ukraine conflict: Biden sanctions Russia over ‘beginning of invasion’

- Puma registers ENS domain, changes name to Puma.eth on Twitter

- EU reportedly plans to task a new money laundering agency with oversight of crypto

- ‘Frozen’ Bitcoin Tied to Canadian Protests Lands at Coinbase, Crypto.Com

? It’s Getting Hot in Here

In our hot token series we have already covered identifying token opportunities and using Nansen to make better trading decisions. Today we will show how to track the activity of top crypto investors, using the Maker DAO token as an example.

Step 1: Identifying Top Crypto Investors

Nansen allows us to find which smart money wallets hold the most of any token, and exactly what they have been doing. This can help us understand which crypto investors have shown faith in a project and what they are doing with their tokens in real time:

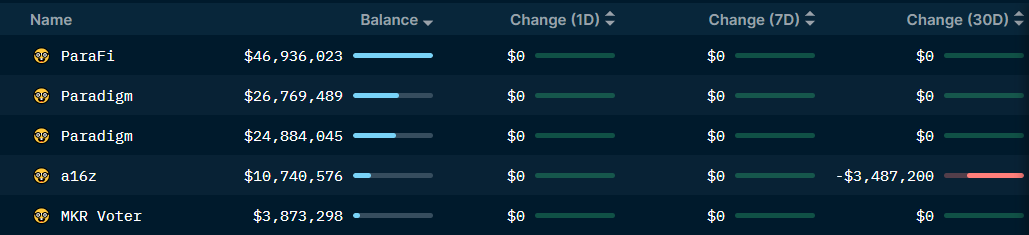

Nansen.ai: 23/02/2022 – Smart Money Token Profiler: Maker DAO (MKR)

- 4 of the 5 largest smart money holders are crypto funds, making up over $114m

- ParaFi and Paradigm have not moved any of their holdings in the last 30 days. This is a good sign and shows that the funds are not selling, despite market conditions.

Step 2: Dive Deeper into Whale Transactions

Unlike the other two funds, a16z have transferred tokens out of their wallet. We can use Nansen to show exactly what they have done from their first purchase until today.

(1) Initial Purchase

We can filter the list of smart money investors by “a16z” to see all known wallet addresses that have held MKR. This gives us two wallets, one of which can shed light on their initial buy:

Nansen.ai: 23/02/2022 – Wallet Profiler: 0x29de91585b93827370ffc104c502df07232bb852

- The first purchase of MKR tokens took place in September 2018.

- These transactions occurred over 10 days before the official announcement. Using Nansen you would have known about this before the rest of the market.

- The fund then transferred these tokens into another of their wallets.

(2) Token Activity

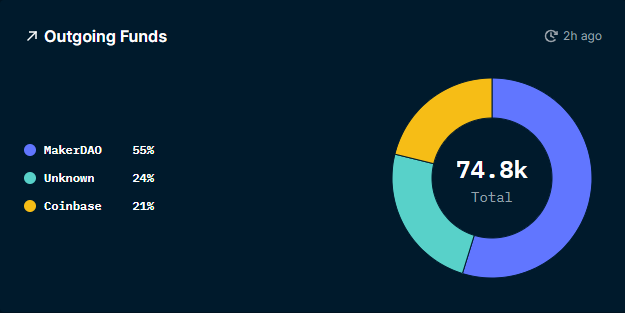

We can now consider all the outgoing transactions made from the new wallet:

Nansen.ai: 23/02/2022 – Wallet Profiler for Token (MKR): 0x05e793ce0c6027323ac150f6d45c2344d28b6019

- 55% of outgoing funds have gone to Maker DAO themselves. This can represent staking and voting features, showing that a16z have taken an active role within the ecosystem.

- 21% of all outgoing funds have gone to Coinbase – a venue that may represent sales. None of these transfers however, have been made in the last 30 days.

Tip: Nansen tracks on-chain activity, not the entire picture. This information should only be used in confluence with your trading system not as a sole indicator.

Conclusion

Understanding other investors is an important part of vetting token opportunities. Using Nansen we are able to understand which top crypto investors are holding a token and what they are currently doing with it. For Maker DAO, we can see that 3 top funds are involved and that none of them are publicly selling their tokens at this moment in time.

? Terran Up the Charts

Terra’s LUNA token has neared $60 potentially due to steps taken to further help UST maintain its peg in some worst-case scenarios. Luna Foundation Guard (LFG) closed a $1 billion OTC token sale for a Forex Reserve for Terra’s UST stablecoin with Jump Crypto and Three Arrows Capital leading the round.

- UST, Terra’s flagship stablecoin, works differently from other stablecoins like USDT. Instead of being backed by dollars, UST’s price stabilizes by its users swapping UST and LUNA.

- In a downward trending market, arbitrageurs may be less inclined to do this if the price of LUNA is in steep decline. Introducing the BTC reserve gives Terra users the option of swapping UST to bitcoin, which is significantly less correlated to Terra’s ecosystem than LUNA.

- Bitcoin is the first step in possibly expanding the non-correlated assets within the market to the reserve.

Terra’s Anchor protocol is one of the most popular options for earning yields in the DeFi market. UST and LUNA play key roles in unlocking the returns of this protocol. If you’re keen on getting the most out of your Terra experience, start here.

Keep missing pumps and opportunities? Consider becoming a FREE subscriber to stay ahead of the crypto market.

? Free subscribers get full access to:

- ✅ Our Daily Crypto Newsletter

- ✅ Bitcoin Reports and Ethereum Deep Dives

- ✅ Altcoin Analysis and Crypto Project Coverage

- ✅ Regular Technical Analysis

- ✅ Podcasts With Crypto Leaders

? The Bridge from Blockchain to Wall Street

Stock transfer agents have an important job behind the scenes that allow businesses and investors to own and trade stocks.

- They have gotten a bad rep lately, mainly due to inefficiencies in their execution of trades.

- Securitize, a blockchain-based company, aims to change that starting with their acquisition of the agency, Pacific Stock Transfer.

- A blockchain record would bring greater security and transparency to the financial services industry in many ways.

- It would allow companies to know the ownership of each shareholder, transfer of securities between investors’ wallets using atomic swaps and dividends could be paid more efficiently using stablecoins, such as USDC.

Securitize has a lofty goal, to make all the world’s assets digital, as well as a mission to decrease friction and create liquidity in the private sector. This acquisition of Pacific Stock Transfer will give Securitize over 1.2 million accounts, making it one of the top ten transfer agents in the world.

- Canadian rapper Drake recently gifted rapper Kodak Black 6.6 #bitcoin worth over $254k – Bitcoin Magazine

- Here’s a really interesting chart I just found. Comparing the amount of stablecoins on exchanges relative to Bitcoin’s market cap gives what I’m calling “Dry Powder Ratio”. Currently at an all-time high, this shows there’s a lot of dry powder ready to be deployed – Will Clemente

- Mexican Senator will submit #Bitcoin Legal Tender bill in 2022 – Bitcoin Archive

Next week we’ll be completing our hot tokens series with a full guide on identifying hot tokens. Prepare for the heat!

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.