🧘♂️Liquid Staking for Beginners

Market Meditations | April 7, 2022

Dear Meditators

Solana is a major player in the DeFi space.

As money has continued to come into decentralized finance, protocols on Solana have been thriving, while new ones keep popping up.

Today we’re looking at one protocol with mouth-watering potential. Let’s dive into Marinade Finance, where the yields are juicy, and the stake is always marinaded.

Today’s Meditations:

- Introduction to Marinade Finance

- Terra Grows Stronger

- BAYC Scam

⏰ Top Headlines

- Bolt to enable Bitcoin and NFT access via Wyre acquisition

- Crypto.com to Pay Bitcoin Bonuses to UFC Fighters

- BreederDAO Share Their Whitepaper

- Frax Finance may buy large amounts of major cryptos to back its stablecoin

? How to Marinade Your Stake

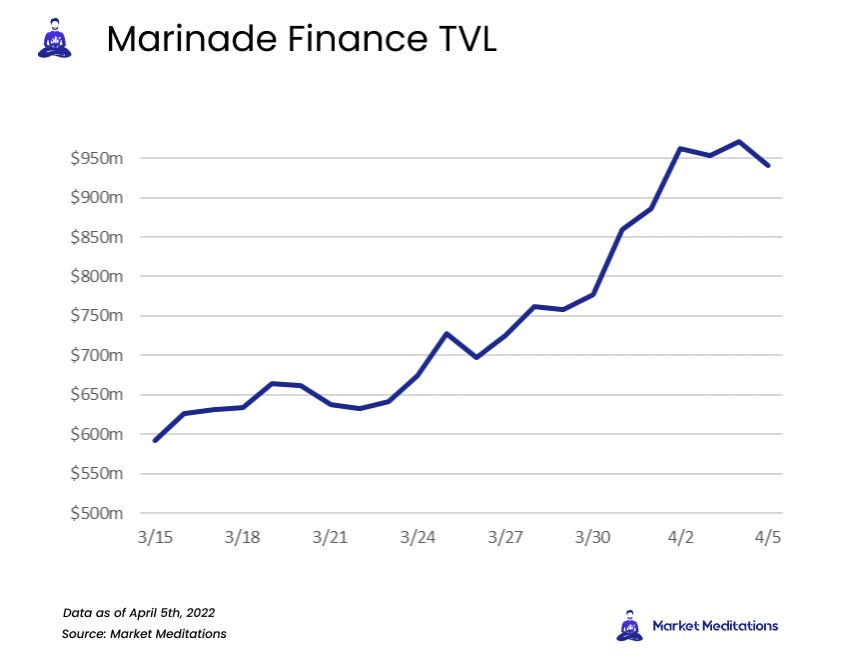

Marinade Finance is a liquid staking solution built on the Solana network. As we can see, Marinade’s total value locked has increased by almost $300 million since the ides of March. This proof of growth results from drawing investors with promising rewards.

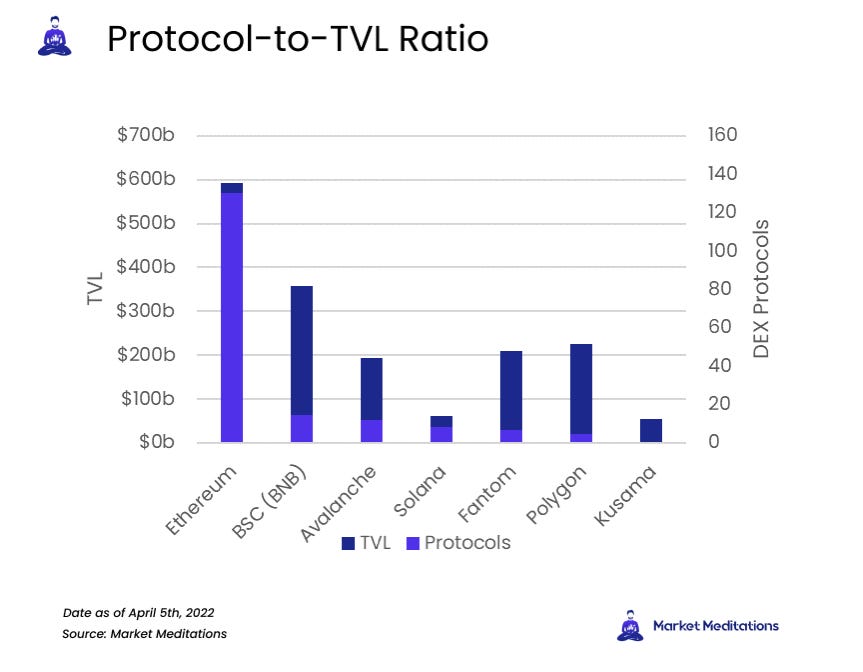

The chart below shows how many protocols exist on each network relative to their total value locked. Solana is second only to Ethereum when it comes to how many choices populate their respective DeFi ecosystems.

Marinade has streamlined liquid staking in a few simple steps:

- Investors start by visiting Marinade’s site and connecting their wallets. One of the most popular wallets on Solana is Phantom.

- Once connected, entering the amount desired to be staked and clicking “Estimated results” will display a projected profit for staking SOL from the present up to 1 year in the future.

- After the staking has been completed, SOL will be deposited, and mSOL will be distributed in return. At this point, the advertised yield is being years. To dive deeper, click “DeFi” at the top of the screen.

- This will display an aggregated list of yield opportunities across different protocols. Clicking “Deposit” or “Add Liquidity” leads to the site for each of the listed opportunities.

- Many investors stake their SOL for maximum return, then either stake mSOL as a single asset or provide it to a liquidity pool paired with another asset.

Using which, if any, of the above options should depend on several factors like risk tolerance, investment duration, and other factors which make up a comprehensive strategy.

- Single-asset deposits avoid the risk of impermanent loss, while the mSOL-SOL pairing theoretically minimizes it, and unlike assets, pairs are completely exposed to it.

- APR/APY rates fluctuate. When choosing a liquidity pool requiring a lock-up term, think about the trajectory of the rewards rate.

- More protocols involved equates to more risk exposure. Hacks and exploits can happen to any protocol, no matter the security precautions taken.

- Combining rewards brings the most return, but also carries the highest risk.

Offering some of the highest rates for staking Solana by itself, Marinade is one of the most enticing protocols in Solana DeFi.

? The Terra Ecosystem Grows Stronger

The Terra (LUNA) ecosystem has shown considerable strength and shows no signs of slowing down. According to a press release shared by CryptoSlate, Terraform Labs has partnered with Web3- focused venture fund LongHash Ventures. The new partnership is known as the LongHashX Accelerator and will help teams looking to build in the Terra ecosystem.

LongHash Ventures and Terraform Labs will provide access to their network of expert investors, founders and technical experts to prospective startups.

- The newfound partnership will invest $200,000 upfront and up to $300,000 in additional investment for successful projects.

- The LongHashX Accelerator has been running for the last 4 years and has helped startups within the Polkadot, Filecoin & Algorand ecosystems.

- 10 projects will join the Accelerator in a 12-week program that aims to equip the builders and founders with the knowledge and network to successfully launch their products.

The program will come to an end with a ‘Demo Day’ where the selected startups will have the opportunity to pitch their products to potential investors. To learn more about how Terra’s native LUNA token is used to maintain the peg of the native UST stablecoin, check out one of our previous ‘Big Ideas’ here.

? Another Ape Bites the Dust

With the varying range of NFTs, none come as popular as the Bored Apes (BAYC). A couple of days ago, one collector was scammed and lost over $570,000 to the scam swap that involved a fake BAYC NFT.

- Over a third-party service – swapkiwi, a collector was scammed out of a BAYC. Unlike other marketplaces like OpenSea, Swapkiwi allows NFT swaps between collectors reducing the gas fees.

- The scammer used images of actual Bored Apes and created fake replicas. The scammer then edited a checkmark (noting a verified NFT) onto the PNG.

- The verified checkmark should appear on the outside of the image to prevent these copycat attacks. Swapkiwi is working to improve the platform to prevent future scams.

- One collector lost out on a valuable and rare bubble gum ape (BAYC #1584) and two mutant apes that were worth over $570,000 to the scam swap.

- Swapkiwi released a statement telling customers to always double-check [NFTs] on OpenSea or Etherscan to ensure authenticity.

The scammer sold the bubble gum ape significantly lower than the BAYC floor, likely because they wanted to make it a fast transaction. The scammer also sold off both mutant ape derivatives at prices lower than the floor price for the collection. Remember to always take maximum precaution when purchasing/swapping an NFT to ensure authenticity.

Delighted to say this article is brought to you by crypto.com, the world’s fastest-growing crypto app. Our favourite features:

- ? Earn Interest. Grow your portfolio by earning up to 14% interest on your crypto assets.

- ? Crypto.com Visa Card. Spend with the crypto.com Visa Card and get up to 8% back.

- ✅ Buy and Sell Cryptos. Join 10m+ users buying and selling 100+ cryptocurrencies at true cost.

You can use our link to download the crypto.com app.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliates, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.