🧘♂️Secret Profit Strategy

Market Meditations | March 10, 2022

Dear Meditators

The dust is settling today following the excitement of Joe Biden’s executive order yesterday.

If we look beyond price action, there are a lot of interesting developments bubbling under the surface.

We’re here to make sure you don’t miss them.

Today’s Meditations:

- Anchor Deep Dive

- Joe Biden’s Executive Order

- Big Moves From Adobe

⏰ Top Headlines

- eBay Teases ‘Digital Wallet’ in Investor Presentation as Crypto Rumors Swirl

- Ethereum Layer 2 developer StarkWare is raising funds at a $6 billion valuation

- US Inflation Rises to 7.9% in February, Fresh 4-Decade High

- Stripe launches payments support for crypto businesses, partners with FTX

⚓ Terra Refuses To Be Anchored

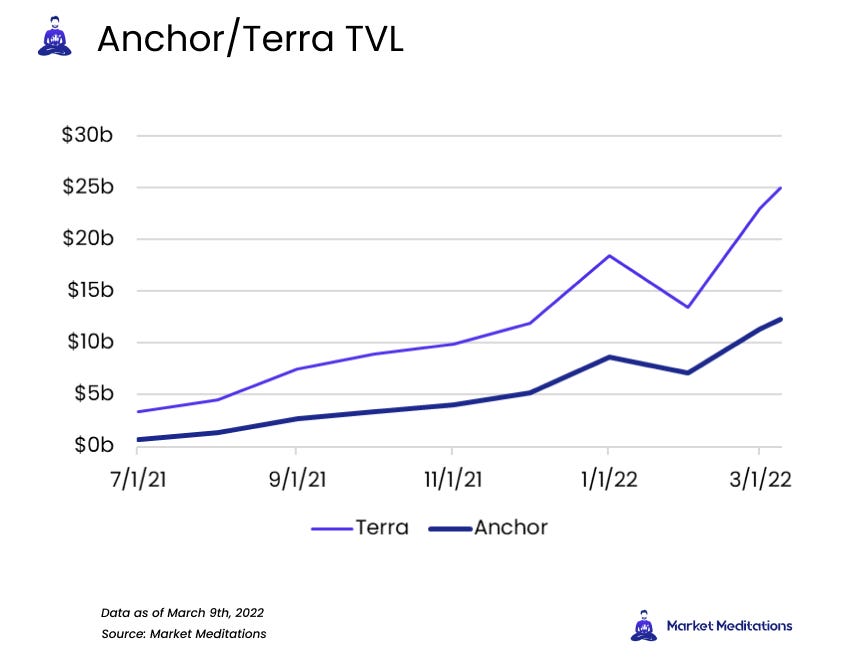

If we consider the chart below, we can see that in the broader context, the TVL in Terra’s DeFi ecosystem has been on a consistent upward trajectory. Anchor’s TVL behavior over the same time span has been commensurate.

Money has been flowing into Terra, and some strong evidence suggests that it’s going into Anchor.

Those who interact with the ecosystem usually consider the following steps.

Set Up Terra Station Wallet

- Download the Terra Station Wallet. Terra Station will allow you to store tokens in the Terra network as well as deposit and withdraw assets using Anchor Protocol.

- Connect your wallet to Anchor Protocol. Click “connect wallet” in the top right corner of the page.

- Fund your wallet. Transfer any eligible tokens into Terra Station. The two most popular options are LUNA and UST.

The easiest way to earn using Anchor is depositing UST into the platform. Borrowers pay interest rates which are redistributed to depositors as rewards for providing liquidity in the protocol.

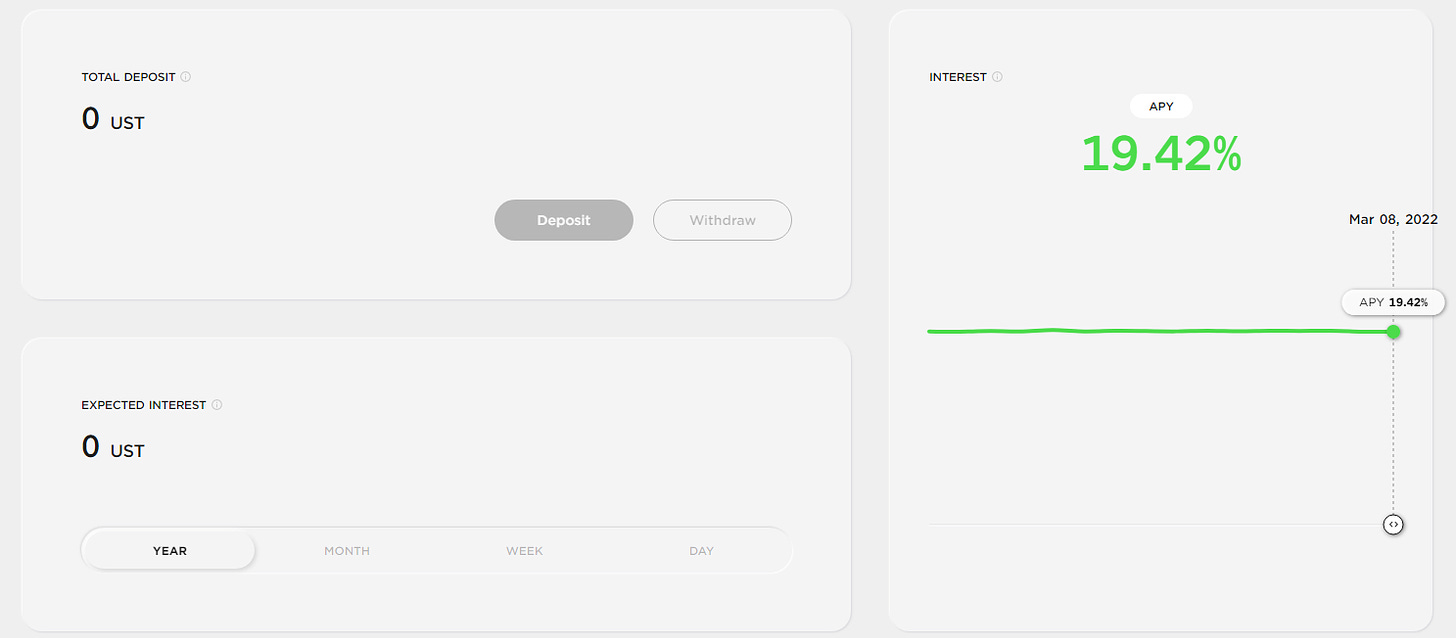

- From the Anchor Dashboard, click the “Earn” tab at the top of the page.

- To deposit UST, click “Deposit” and select the desired amount. The “Expected Interest” section will display projected earnings by year, month, week, or day.

- The current offered interest rate will be displayed in the “Interest” section on the right.

- The fee for depositing and withdrawing UST with Anchor protocol averages around $0.25UST.

- There is no lock up term for depositing UST to earn the featured APY%. Funds can be deposited or withdrawn at any time.

- Rewards are distributed to accounts every block completion (about 6 seconds on average) and will be reflected in the “Total Value” section of the “My Page” tab.

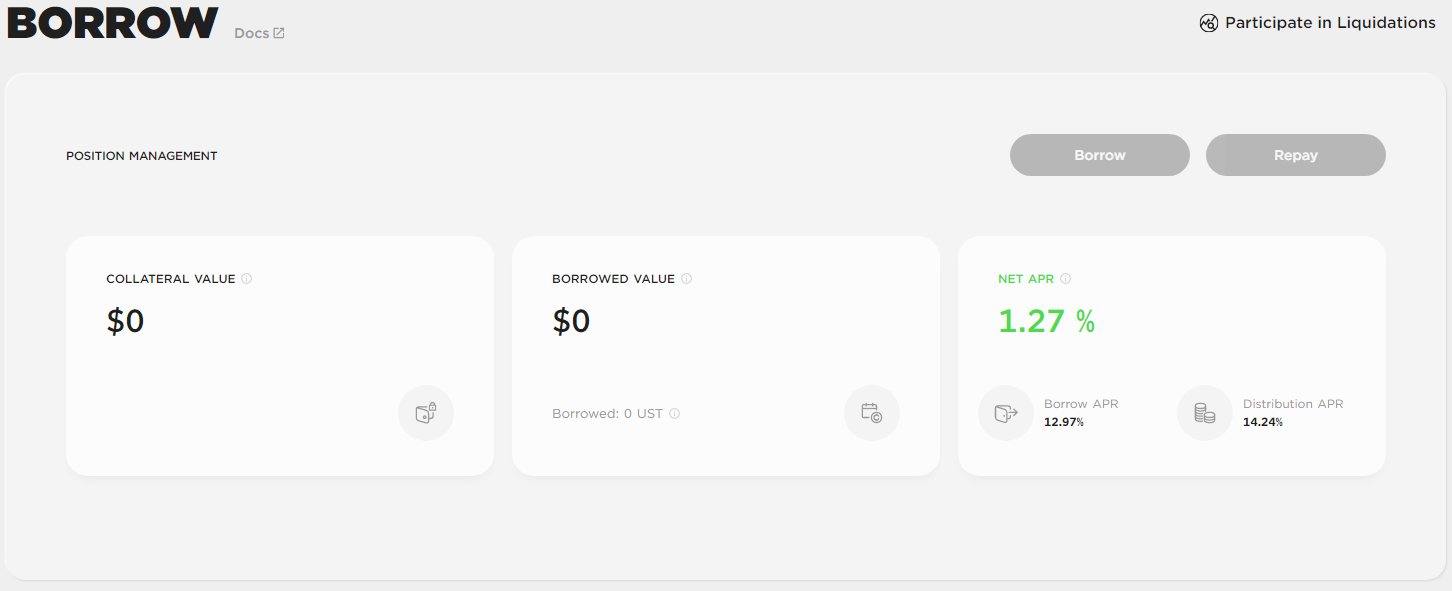

Borrowing can be done until the loan-to-value (LTV) ratio reaches the maximum LTV allowed. If, at any point, the TVL exceeds the limit, any provided collateral is subject to liquidation.

TIP! An attractive feature of borrowing on Anchor is its Net APR. When users borrow on Anchor, they receive Anchor Protocol tokens (ANC). If the net APY% is positive, the ANC rewards paid out to borrowers exceed the interest paid on the loan, essentially resulting in being paid to borrow.

Crypto investors that explore these avenues are aware of the risks. The risks associated with Yield Farming include but are not limited to:

- Smart Contract Risk

- Oracle Failure

- Governance Attacks

- Yield Fluctuation

- Impermanent Loss (learn more about it here)

- Systemic Risks

- De-pegging of Assets

There are no guarantees in DeFi. Always do your own research and never invest more capital than you can afford to lose.

? Bidens Executive Order

A few days ago we hinted that further regulation of digital assets is on its way. The Executive Order has arrived with 10 key sections outlined. We strongly suggest that you check it out here but if you don’t have time, here is what you need to know:

- The Executive Order’s key objective is to “ensure that safeguards are in place and to promote the responsible development of digital assets to protect consumers, investors and businesses”.

- The Order highlights that crypto can be used for illicit finance and that “regulation, oversight, law enforcement action or use of other United States government authorities” will be used to combat this. This could suggest that tighter KYC action will be required, at least in the US.

- Biden does make it clear that the US wants to use the technology to expand equitable access to finance especially for the Americans who are currently underserved.

The Order has mandated the treasury department to publish a report on the future of money and the problems of the traditional financial system.

? Adobe leveling up!

Adobe’s social network, Behance, is adding support so that users can easily showcase their Polygon-based NFTs.

- Behance is promoting Polygon integration as being more environmentally friendly. This comes from artists saying that NFTs are not particularly conscious of the environment.

- Polygon has a smaller energy footprint for individual crypto transactions, though it works atop the Ethereum blockchain.

- Adobe launched a program called Content Authenticity Initiative which not only identifies the creator of the image but also where the image was edited.

- This past Monday, Behance also announced that users can connect their phantom wallets to showcase their Solana NFTs. Solana similarly tends to artists wanting an environmentally friendly option within crypto.

Though it can be easy to get caught in the hype of one social network, staying up-to-date with this kind of news will aid one’s decision-making when investing.

- Your eyes are wide open, but you haven’t seen anything yet. ? The #Exorians are rising. – The Exorians Universe

- BREAKING: Inflation was just reported at 7.9%. This is the highest inflation in decades. (Thread) – Pomp

- NEW: ?? Thailand’s multi-billion dollar SCB becomes the world’s second major bank to enter the Metaverse – Blockworks

- BREAKING: Goldman Sachs Will Offer $ETH Trading to Clients – Market Meditations

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.