Stablecoins 101

Market Meditations | May 13, 2022

? Unstablecoins

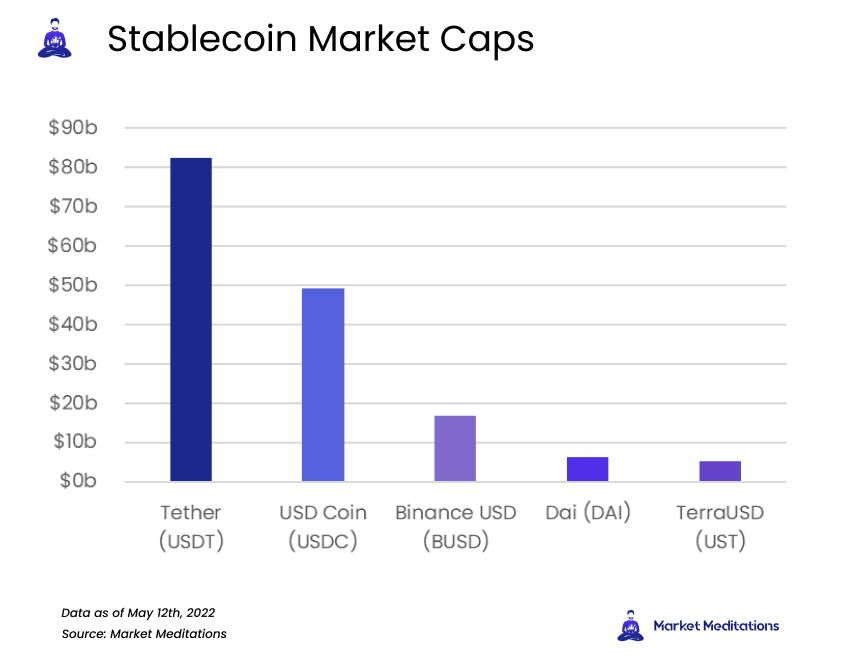

Stablecoins literally have one job: stability. As we see in the graphic below, the top five stablecoins by market cap currently account for over $160 billion. With that much money at stake, nothing can be taken for granted.

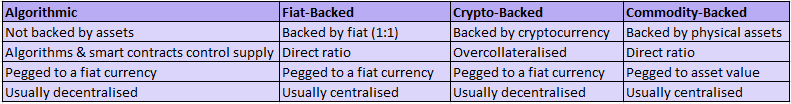

We use stablecoins for everything from hedging against volatility to blockchain interconnection. But with uncertainty in the markets, we’ve taken a deeper look into these popular assets. In the following sections, we explain how the main stablecoins operate and what the security and safety mechanisms are for each. Every coin is also grouped into its relevant category. For a breakdown of the categories refer to the following table:

Different Types of Stablecoins

#1 Tether (USDT)

- What is it: USDT is a fiat-backed stablecoin hosted on the Ethereum blockchain. According to Tether, each USDT is backed by the U.S. dollar at a 1:1 ratio.

- Risk assessment: In 2021, Tether was required to pay $41 million by the U.S. Commodity Futures Trading Commission resulting from allegations of making untrue statements about how its stablecoin was backed.

- Due Diligence: According to the last Independent Accountant Report, Tether’s reserves are made up of traditional currency to the tune of 83.74% held in cash & cash equivalents in addition to other short-term deposits & commercial paper. Scrutinising these publications would serve you well in responsible investment decisions.

There has been a lot of panic recently surrounding USDT’s deviation from its peg to $0.95 in the wake of the devastation on Terra. However, there are some key differences between the two.

- USDT has more severely deviated from its peg in the past and quickly corrected. In 2017, its peg was lost, dropping as low as $0.91 when approximately $31 million was stolen in a hack.

- Tether Chief Technology Officer Paolo Ardoino took to Twitter to reassure that USDT redemptions would always be honoured at $1, citing “$300m redeemed in the last 24 hours without a sweat drop.”

- The USDT price took about 8 hours yesterday to re-establish the $0.99 mark, and is trading at $0.999 according to CoinMarketCap at the time of writing.

#2 USD Coin (USDC)

- What is it: USD Coin is a fiat-backed stablecoin managed by Centre (a consortium co-founded by Coinbase and Circle). Like other stablecoins at the top of this list, it’s backed by fiat at a 1:1 ratio.

- Risk assessment: USDC is fully backed by short-term U.S. government obligations and cash to keep it perpetually redeemable at all times.

- Due Diligence: Attestation reports regularly to provide transparency for the coin’s backing. Do not take backing for granted! Spend the time reading them.

#3 Binance USD (BUSD)

- What is it: BUSD is issued by Binance in partnership with Paxos, and rounds out the top 3 stablecoins by market cap. It should come as no surprise that it’s also backed by fiat.

- Risk assessment: Paxos holds a number of dollars equal to the total supply of BUSD in FDIC-insured U.S. banks or backed by U.S. Treasuries.

- Due Diligence: Paxos also issues monthly attestation reports to provide transparency to users into the current breakdown of fiat backing.

#4 Dai (DAI)

- What is it: Dai is an Ethereum-based ERC-20 token indirectly pegged to the U.S. dollar created by MakerDAO.

- Risk assessment: DAI is decentralised, and not backed by a stable asset like the U.S. dollar, unlike the stablecoins above. Instead of being supported by an equivalent amount of currency off-chain, DAI tokens are propped up by overcollateralized debt denominated in ETH.

- Due Diligence: Since Dai is minted only after collateral has been provided, responsible research here begins with looking at smart contracts and audits. Reading Dai’s whitepaper is an absolute must.

#5 TerraUSD (UST)

- What is it: UST is an algorithmic stablecoin, using the value of Terra’s Luna token and proportionate minting/burning mechanisms to control the supply and value of UST.

- Risk assessment: As an algorithmic stablecoin, TerraUSD is not backed by any collateral, though recently Bitcoin and Avalanche (AVAX) were added as a safeguard should the mechanism fail. Unfortunately, this proved to be insufficient.

- Due Diligence: Early warning signs criticising its structure surrounded Terra’s meteoric rise in market cap. Even if whitepaper interpretation isn’t in one’s skillset, the research could have kept us all out of a sticky situation.

If looking to escape some volatility in this dangerous crypto market, stablecoins have traditionally been a no-brainer. However, without diligently researching these assets, investing in them would be brainless.

Take the time to understand a coin before buying in, nothing is guaranteed, but knowledge is always the safest bet.